Cash Stuffing Method: Complete Guide to Viral TikTok Budgeting Trend 2025

The cash stuffing method is a viral TikTok budgeting system that helps people save more than $5,000 a year by managing expenses through labeled cash envelopes. This complete 2025 guide shows you how to start envelope budgeting, set spending categories, and build consistent money discipline step by step.

Learn the envelope budgeting system that's helped millions of people take control of their finances and save thousands using physical cash

If you've been scrolling through TikTok or Instagram lately, you've probably seen the viral "cash stuffing" videos with millions of views. People are showing off their colorful budget binders, stuffing envelopes with cash, and sharing how they've saved thousands of dollars using this simple method.

But is cash stuffing just another social media trend, or is it a legitimate budgeting strategy that can help you save money? The answer: it's one of the most effective budgeting methods available, and it's been around for decades under the name "envelope budgeting system."

In this comprehensive guide, you'll learn everything about the cash stuffing method, including how to start, what supplies you need, common mistakes to avoid, and real success stories from people who've saved over $5,000 using this technique.

3+ Billion

TikTok views for #cashstuffing and related hashtags

Table of Contents

What is Cash Stuffing? (The Modern Envelope Budgeting System)

Cash stuffing is a budgeting method where you withdraw your monthly budget in physical cash and divide it into labeled envelopes for different spending categories. Each envelope represents a specific budget category (like groceries, gas, entertainment, or dining out), and you can only spend what's in that envelope.

When an envelope is empty, you stop spending in that category until the next budget period. It's that simple.

Quick Definition

Cash Stuffing: A budgeting technique where you allocate physical cash into labeled envelopes for different spending categories, creating a tangible, visual system that prevents overspending and helps you stick to your budget.

The History: From Envelope System to TikTok Trend

The envelope budgeting system isn't new—it's been recommended by financial experts like Dave Ramsey for decades. What's new is the aesthetic, social media-friendly version that's gone viral on TikTok and Instagram.

Modern cash stuffers have transformed the basic envelope system into an engaging, visually appealing practice with:

- Colorful budget binders with plastic sleeves instead of plain envelopes

- Decorative labels and stickers to make budgeting fun

- Cash stuffing videos showing the satisfying process of organizing money

- Community support through hashtags like #cashstuffing, #budgetbinder, and #cashenvelopes

- Accountability by sharing progress and goals publicly

The hashtag #cashstuffing alone has over 3 billion views on TikTok, making it one of the most popular personal finance trends of 2024-2025.

Why Cash Stuffing Works: The Psychology Behind the Method

Cash stuffing isn't just a budgeting gimmick—it's backed by psychological research on spending behavior. Here's why using physical cash makes such a dramatic difference:

1. The Pain of Paying

Studies from MIT and Carnegie Mellon found that people experience actual psychological pain when handing over physical cash. This "pain of paying" is significantly reduced when using credit or debit cards because the transaction feels abstract.

Research Finding

People spend 12-18% less when using cash instead of cards, according to multiple consumer behavior studies. For someone spending $3,000 monthly on variable expenses, that's a savings of $360-540 per month, or $4,320-6,480 annually.

2. Visual Budget Awareness

When you can physically see your money disappearing from an envelope, you become hyper-aware of your spending. Digital transactions happen invisibly in the background, making it easy to lose track.

With cash stuffing, you can literally see:

- How much money you have left in each category

- Which categories you overspend in

- When you need to slow down spending

- Your progress toward savings goals

3. Forced Spending Limits

Credit and debit cards have high limits or direct access to your entire bank account, making it easy to overspend "just this once." With cash envelopes, when the money is gone, it's gone. This creates a hard stop that prevents impulse purchases and budget creep.

4. Reduced Impulse Buying

Having to physically count out cash and hand it over creates a moment of pause before each purchase. This brief delay gives your brain time to ask, "Do I really need this?" instead of mindlessly tapping your card.

Real Example

Sarah's Story: "I used to spend $800-900 monthly on groceries for my family of four, constantly going over budget. After switching to cash stuffing with a $600 grocery envelope, I became much more strategic. I meal planned, used coupons, and avoided impulse buys. Now I consistently stay under $600, saving $200-300 every month. That's $2,400-3,600 per year!"

5. Gamification and Motivation

Cash stuffing turns budgeting into a game. Seeing cash left over at the end of the month feels like winning. Many people report that the visual satisfaction of organized envelopes and growing savings motivates them to stick with their budget longer than any app or spreadsheet ever did.

How to Start Cash Stuffing: Complete Step-by-Step Guide

Ready to try cash stuffing? Follow this detailed guide to set up your system in less than a week.

1Calculate Your Budget

Before you can stuff envelopes, you need to know how much money to allocate to each category.

Action steps:

- Track your spending for 30 days (use a budgeting app or review bank statements)

- Calculate your total monthly income (after taxes)

- List all fixed expenses (rent, utilities, insurance, subscriptions, debt payments)

- Subtract fixed expenses from income to find your variable spending amount

- Divide variable spending into categories based on your actual spending patterns

Use Our Budget Calculator

Not sure how to calculate your budget? Use our free Budget Calculator to automatically calculate your income, expenses, and recommended category amounts based on the 50/30/20 rule.

Example Budget Breakdown:

- Monthly Income: $4,500 (after taxes)

- Fixed Expenses: $2,800 (rent $1,500, utilities $200, car payment $300, insurance $200, subscriptions $100, minimum debt payments $500)

- Variable Spending: $1,700 (available for cash envelopes)

2Choose Your Categories

Select 4-8 spending categories for your cash envelopes. Start with categories where you tend to overspend or lose track of spending.

Most popular cash stuffing categories:

- Groceries: $500-800/month (most important category)

- Dining Out/Restaurants: $100-300/month

- Gas/Transportation: $100-200/month

- Entertainment: $50-150/month

- Personal Care/Beauty: $50-100/month

- Clothing/Shopping: $50-200/month

- Household Items: $50-100/month

- Fun Money/Miscellaneous: $50-100/month

Important Note

Don't use cash for fixed bills (rent, utilities, insurance) or online purchases. Keep those on autopay through your bank account. Cash stuffing works best for in-person, variable expenses where you're most likely to overspend.

3Prepare Your Envelopes

Now it's time to set up your physical envelope system.

What you need:

- Cash envelopes or a budget binder with plastic sleeves

- Labels or a label maker

- A budget tracker or notebook

- A safe or lockbox for storage

Setup process:

- Label each envelope with the category name and budget amount (e.g., "Groceries - $600")

- Organize envelopes in a binder or box in order of frequency of use

- Create a tracking sheet to record starting amounts and spending

- Set up a secure storage location at home (safe, locked drawer, or hidden spot)

4Withdraw Cash

Go to your bank and withdraw your total monthly budget in cash. This is usually done at the beginning of each month or when you get paid.

Cash withdrawal tips:

- Request a mix of bills: $1, $5, $10, and $20 bills (avoid $50 and $100 bills—they're harder to break)

- Withdraw the exact amount you budgeted for all categories combined

- Consider withdrawing weekly or bi-weekly if monthly feels overwhelming

- Let your bank know in advance if you're withdrawing a large amount ($1,000+)

Pro Tip

If you're paid bi-weekly, consider doing cash stuffing twice per month instead of once. This makes the amounts more manageable and aligns with your paycheck schedule.

5Stuff Your Envelopes

This is the satisfying part that makes for great TikTok content!

Stuffing process:

- Lay out all your labeled envelopes

- Count out the budgeted amount for each category

- Place the cash in the corresponding envelope

- Double-check that all amounts are correct

- Record the starting amount in your tracker

- Store envelopes securely

Many people make this a monthly ritual, sometimes filming it for social media accountability or simply enjoying the meditative process of organizing their finances.

6Spend Only From Envelopes

Now comes the discipline part: you can only spend what's in each envelope.

Spending rules:

- When shopping, bring only the relevant envelope (e.g., grocery envelope for grocery shopping)

- Pay with cash from that envelope only

- Put receipts and change back in the envelope immediately

- Track spending in your notebook or app

- When an envelope is empty, stop spending in that category

- No borrowing from other envelopes (or set strict rules if you must)

Success Tip

At the end of the month, any leftover cash in envelopes can be: 1) Rolled over to next month's envelope, 2) Moved to a savings envelope, or 3) Used as a reward. Most successful cash stuffers choose option 2—leftover money goes straight to savings, creating a positive feedback loop.

Helpful Calculators for Cash Stuffing

Budget Calculator

Calculate your monthly budget and see how much you should allocate to each spending category using the 50/30/20 rule.

Calculate BudgetSavings Calculator

See how much you can save over time with consistent cash stuffing and calculate your savings goals.

Calculate SavingsPaycheck Calculator

Calculate your take-home pay after taxes to know exactly how much cash you can withdraw for stuffing.

Calculate PaycheckDebt Payoff Calculator

Plan your debt payoff strategy while using cash stuffing to stay on track with your budget.

Calculate Debt Payoff

The 100 Envelope Challenge: Save $5,050 in 3-4 Months

The 100 envelope challenge is a specific cash stuffing variation that's gone massively viral on TikTok. It's a fun, gamified way to save over $5,000 in just a few months.

How the 100 Envelope Challenge Works

Setup:

- Get 100 envelopes

- Number them from 1 to 100

- Mix them up in a box or basket

The Challenge:

- Each day (or week), randomly pick one envelope

- Put the dollar amount matching the envelope number inside (envelope #1 = $1, envelope #47 = $47, envelope #100 = $100)

- Seal the envelope and set it aside

- Continue until all 100 envelopes are filled

$5,050

Total savings when you complete the 100 envelope challenge

Timeline Options

You can adjust the timeline based on your budget:

- Daily (100 days): Pick one envelope per day = $5,050 in 3.3 months (aggressive, requires $50.50/day average)

- Twice Weekly (50 weeks): Pick two envelopes per week = $5,050 in about 1 year (moderate, requires $101/week average)

- Weekly (100 weeks): Pick one envelope per week = $5,050 in about 2 years (easy, requires $50.50/week average)

Pro Tip

Most people do 2-3 envelopes per week, completing the challenge in 8-12 months. This makes it manageable while still building significant savings quickly.

Variations of the Challenge

If $5,050 feels too aggressive, try these modified versions:

- 50 Envelope Challenge: Number envelopes 1-50, save $1,275 total

- 200 Envelope Challenge: Number envelopes 1-200, save $20,100 total (for high earners)

- Reverse Challenge: Start with high numbers first (easier psychologically)

- Bi-Weekly Challenge: Align with paycheck schedule, pick envelopes on payday

Success Story

Marcus's Experience: "I completed the 100 envelope challenge in 4 months by doing 2-3 envelopes per week. Some weeks I'd pick low numbers (easy), other weeks I'd get stuck with #87 and #93 (ouch!). But the randomness made it fun, like a game. I saved $5,050 and used it as a down payment on a used car. Best financial decision I've made!"

Supplies You Need to Start Cash Stuffing

You don't need expensive supplies to start cash stuffing. Here's what you actually need and what's optional:

Essential Supplies (Required)

1. Cash Envelopes or Budget Binder

Options:

- Free envelopes from your bank

- Plain white envelopes from office supply store ($3-5 for 100)

- Budget binder with plastic sleeves ($15-30 on Amazon)

- Accordion file folder ($8-15)

Recommendation: Start with free bank envelopes. Upgrade to a fancy binder later if you stick with it.

2. Labels or Label Maker

Options:

- Handwritten labels (free)

- Printable labels ($5-10)

- Label maker ($20-40)

- Pre-made budget stickers ($8-15)

Recommendation: Handwrite labels to start. A label maker is a nice upgrade but not necessary.

3. Budget Tracker

Options:

- Simple notebook ($2-5)

- Printable budget sheets (free online)

- Budget planner ($10-25)

- Spreadsheet (free)

Recommendation: Use a simple notebook or our free Budget Calculator to track spending.

4. Safe or Lockbox

Options:

- Small safe ($20-50)

- Fireproof lockbox ($30-80)

- Locked drawer (free if you have one)

- Hidden storage spot (free)

Recommendation: Invest in a small safe for security and peace of mind.

Optional Supplies (Nice to Have)

- Decorative stickers and washi tape: $5-15 (makes it aesthetic and fun)

- Colorful pens and markers: $5-10 (for tracking and decorating)

- Zippered cash envelopes: $10-20 (more secure than regular envelopes)

- Budget binder accessories: $10-30 (dividers, pockets, clips)

- Portable cash wallet: $15-25 (for carrying envelopes when shopping)

Total Startup Cost

Minimum: $0-10 (using free envelopes and handwritten labels)

Recommended: $20-50 (basic binder, labels, safe)

Aesthetic Setup: $50-100 (fancy binder, decorations, accessories)

Where to Buy Supplies

- Amazon: Widest selection of budget binders and accessories

- Target/Walmart: Affordable envelopes, notebooks, and basic supplies

- Dollar Store: Envelopes, notebooks, and decorative supplies for $1-3 each

- Etsy: Handmade, aesthetic budget binders and printables

- Office supply stores: Labels, envelopes, and organizational supplies

Best Categories for Cash Stuffing (What Works and What Doesn't)

Not all spending categories work well with cash. Here's a breakdown of what to include and what to skip:

Best Categories for Cash Envelopes

Groceries

Why it works: This is usually the #1 overspending category. Using cash forces meal planning and eliminates impulse buys.

Typical amount: $400-800/month

Savings potential: $100-300/month

Dining Out/Restaurants

Why it works: Easy to overspend with cards. Cash makes you think twice about that $15 lunch.

Typical amount: $100-300/month

Savings potential: $50-150/month

Gas/Transportation

Why it works: Most gas stations accept cash. Helps you track fuel spending accurately.

Typical amount: $100-200/month

Savings potential: $20-50/month

Entertainment

Why it works: Movies, concerts, events, hobbies—all accept cash and are easy to overspend on.

Typical amount: $50-150/month

Savings potential: $30-80/month

Personal Care/Beauty

Why it works: Haircuts, nails, skincare, makeup—using cash prevents overspending on non-essentials.

Typical amount: $50-100/month

Savings potential: $20-40/month

Clothing/Shopping

Why it works: Major impulse buy category. Cash forces you to think before buying that "cute top."

Typical amount: $50-200/month

Savings potential: $30-100/month

Categories to AVOID for Cash Stuffing

Don't Use Cash For:

- Rent/Mortgage: Keep on autopay for convenience and payment history

- Utilities: Most require online payment or autopay

- Insurance: Autopay ensures you never miss a payment

- Subscriptions: Netflix, Spotify, etc. are digital-only

- Online shopping: Can't use physical cash online (use a separate debit card with a set limit)

- Debt payments: Keep on autopay to avoid late fees

- Savings/Investments: Automate these transfers instead

Hybrid Approach (Best of Both Worlds)

Most successful cash stuffers use a hybrid system:

- Fixed bills: Autopay from checking account

- Variable in-person spending: Cash envelopes

- Online purchases: Separate debit card with low balance or prepaid card

- Savings: Automatic transfers to high-yield savings account

This gives you the control benefits of cash for problem spending areas while maintaining the convenience of digital payments for everything else.

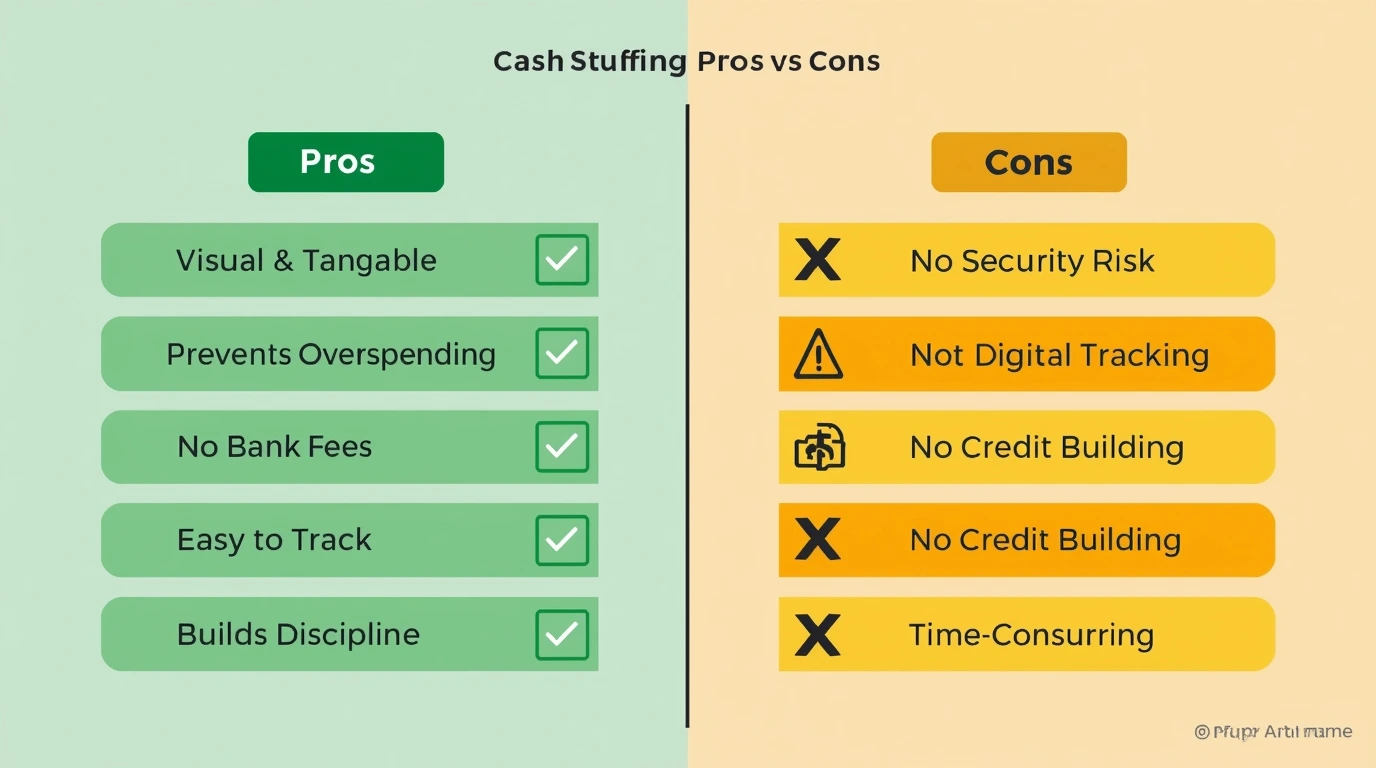

Pros and Cons of Cash Stuffing

Like any budgeting method, cash stuffing has advantages and disadvantages. Here's an honest assessment:

Pros (Why It Works)

- Reduces overspending by 12-18% due to psychological pain of paying with cash

- Visual and tangible - you can see exactly how much money you have left

- Prevents impulse purchases - having to count out cash creates a pause before buying

- No overdraft fees - you can't spend money you don't have

- Builds discipline - forces you to stick to your budget

- Works without technology - no apps, no internet required

- Gamifies budgeting - makes saving money fun and satisfying

- Community support - millions of people sharing tips on social media

- Flexible - customize categories and amounts to your needs

- Immediate feedback - you know instantly when you're running low

Cons (Challenges to Consider)

- Security risk - keeping large amounts of cash at home (mitigated with a safe)

- Inconvenient - requires planning and carrying envelopes when shopping

- Doesn't work for online purchases - need a hybrid system

- No credit card rewards - miss out on cash back or points

- Harder to track digitally - requires manual record-keeping

- Can be time-consuming - monthly cash withdrawal and stuffing takes time

- Awkward in some situations - paying with cash can feel outdated

- Requires discipline - you must resist borrowing from other envelopes

- Initial setup effort - takes time to calculate budget and organize system

- Not ideal for large purchases - carrying $500+ in cash feels risky

Bottom Line

Cash stuffing works best for people who struggle with overspending on variable expenses like groceries, dining out, and shopping. If you're already disciplined with cards or prefer digital tracking, it might not be necessary. However, if you've tried budgeting apps and failed, cash stuffing's tangible nature might be the game-changer you need.

Real Success Stories: People Who Saved Thousands with Cash Stuffing

Here are real examples of people who transformed their finances using the cash stuffing method:

Jessica's Story: Paid Off $8,000 in Credit Card Debt

Background: Jessica, 28, was $8,000 in credit card debt and spending $600/month more than she earned.

What she did: Started cash stuffing with 6 envelopes (groceries $500, dining out $100, gas $150, entertainment $50, personal care $75, miscellaneous $100). Stopped using credit cards entirely.

Results: In 8 months, she reduced spending by $450/month, paid off all credit card debt, and built a $2,000 emergency fund. "Seeing the cash disappear made me realize how much I was wasting. I couldn't lie to myself anymore."

Marcus's Story: Saved $12,000 for a Down Payment

Background: Marcus, 35, wanted to buy a house but couldn't save consistently. He earned $65,000/year but had only $1,500 in savings.

What he did: Combined cash stuffing for variable expenses with aggressive savings. Used the 100 envelope challenge twice, plus regular cash envelopes for daily spending.

Results: In 18 months, saved $12,000 for a down payment. "The 100 envelope challenge was addictive. Once I completed it the first time ($5,050), I immediately started again. Cash stuffing kept my daily spending in check while I built savings."

The Rodriguez Family: Cut Grocery Bill by $400/Month

Background: Family of four spending $1,200/month on groceries and dining out, constantly going over budget.

What they did: Started cash stuffing with $600 for groceries and $200 for dining out. Meal planned every Sunday, shopped with a list, and involved kids in the process.

Results: Reduced food spending to $800/month total, saving $400/month = $4,800/year. Used savings to pay off car loan 2 years early. "Our kids learned the value of money by seeing the envelopes empty. They started suggesting cheaper meal options!"

Aisha's Story: Built 6-Month Emergency Fund

Background: Aisha, 42, had zero emergency savings despite earning $55,000/year. She was living paycheck to paycheck.

What she did: Started with just 4 cash envelopes (groceries, gas, personal spending, fun money). Any leftover cash at month-end went to a "savings envelope" that she deposited into a high-yield savings account.

Results: In 14 months, built a $15,000 emergency fund (6 months of expenses). "I never thought I could save. Cash stuffing made it automatic—leftover money had nowhere to go except savings. I averaged $900-1,100 in savings per month."

$3,000-$7,000

Average first-year savings for consistent cash stuffers

Common Mistakes to Avoid When Cash Stuffing

Learn from others' mistakes to make your cash stuffing journey smoother:

1. Starting with Too Many Categories

The mistake: Creating 15+ envelopes for every possible expense category.

Why it fails: Too complex to manage, overwhelming, and you'll give up quickly.

The fix: Start with 4-6 categories where you overspend most. Add more later if needed.

2. Setting Unrealistic Budget Amounts

The mistake: Cutting your grocery budget from $800 to $400 overnight.

Why it fails: You'll run out of money mid-month and feel like a failure.

The fix: Track actual spending for 30 days first, then reduce by 10-15% initially. Adjust gradually.

3. Constantly Borrowing Between Envelopes

The mistake: Running out of dining out money, so you "borrow" from the grocery envelope.

Why it fails: Defeats the entire purpose of cash stuffing. You're just moving money around.

The fix: Set a strict rule: no borrowing, or if you must, you MUST pay it back next month. Better yet, just stop spending in that category.

4. Not Securing Your Cash

The mistake: Leaving cash envelopes in a drawer or purse where anyone can access them.

Why it fails: Risk of theft, loss, or family members "borrowing" without asking.

The fix: Invest in a small safe ($20-50) and keep it locked. Only carry the envelope you need that day.

5. Giving Up After One Bad Month

The mistake: Running out of money in week 2 and declaring "cash stuffing doesn't work for me."

Why it fails: The first month is always rough as you learn your true spending patterns.

The fix: Commit to 3 months minimum. Adjust your budget amounts based on what you learn each month.

6. Not Tracking Spending

The mistake: Just stuffing envelopes and hoping for the best without recording anything.

Why it fails: You can't improve what you don't measure. You won't know which categories need adjustment.

The fix: Keep a simple notebook or use our Budget Calculator to track spending weekly.

7. Using Cash for Everything (Including Bills)

The mistake: Trying to pay rent, utilities, and subscriptions with cash.

Why it fails: Inconvenient, risky, and most bills require online payment anyway.

The fix: Use the hybrid approach—autopay for fixed bills, cash for variable spending only.

8. Forgetting About Irregular Expenses

The mistake: Not budgeting for annual expenses like car registration, gifts, or vet bills.

Why it fails: These surprise expenses blow your budget and force you to use credit cards.

The fix: Create a "sinking fund" envelope for irregular expenses. Calculate annual costs, divide by 12, and stuff that amount monthly.

Related Articles You Might Like

Complete Mortgage Calculator Guide

Planning to buy a house? Calculate your monthly mortgage payments and see how much house you can afford.

Top 10 Financial Calculators You Need

Discover the essential calculators for budgeting, saving, investing, and financial planning.

YouTube Money Calculator Guide

Thinking about starting a side hustle? Calculate potential YouTube earnings to boost your income.

BMI Calculator and Health Guide

Financial health and physical health go hand-in-hand. Check your BMI and get personalized health tips.

Frequently Asked Questions About Cash Stuffing

Found this helpful? Share it with friends!

Final Thoughts: Is Cash Stuffing Right for You?

Cash stuffing isn't just a TikTok trend—it's a proven budgeting method that's helped millions of people take control of their finances and save thousands of dollars. The psychological power of using physical cash, combined with the visual accountability of envelopes, makes it one of the most effective budgeting strategies available.

Cash stuffing is perfect for you if:

- You struggle with overspending on groceries, dining out, or shopping

- Budgeting apps haven't worked for you in the past

- You want a tangible, visual way to track your money

- You're motivated by seeing progress and having clear limits

- You want to save $3,000-7,000 in your first year

Consider a different method if:

- You're already disciplined with digital budgeting tools

- You do most shopping online

- You're uncomfortable keeping cash at home

- You want to maximize credit card rewards

Ready to Start?

The best time to start cash stuffing was last month. The second best time is today. Start small with 4-6 envelopes, commit to 3 months, and adjust as you learn. Use our Budget Calculator to determine your category amounts, then withdraw your cash and start stuffing!

Remember: The goal isn't perfection—it's progress. Even if you save just $200/month, that's $2,400/year toward your financial goals. You've got this!